The complex world of the Correlation of the Cryptocurrency Market

In the rapidly developing landscape of cryptocurrencies, market correlation is a decisive aspect that can significantly influence investment decisions and risk management. Cryptocurrencies are known for their volatility and unpredictability, which makes prices challenging. Although some cryptocurrencies have shown significant growth, others have experienced considerable invoices. In this article, we are looking at how to evaluate market correlation between cryptocurrencies.

What is market correlation?

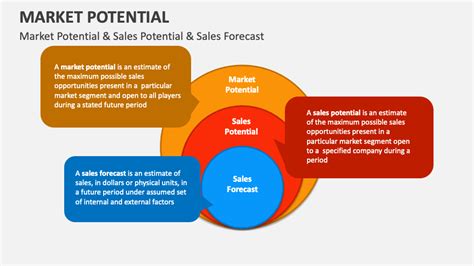

Market correlation refers to a statistical relationship between two or more funds of funds. It is a way to measure the level of similarity in their return over time. In the context of the cryptocurrency market, correlations can be influenced by different factors such as market feelings, macroeconomic conditions and technological development.

Why is correlation important?

Understanding the correlation of the market is vital for investors who seek to maximize return and minimize the risk. A well -known approach to give you:

- Versatile Portfolio : Apply investments between different assets to minimize exposure to any encryption technology performance.

- Avoid market timing : By evaluating the correlations, you can identify which encryption currencies usually move together and distinguish them from weaker relationships.

- Improve risk management : By identifying any correlations you can adapt to your investment strategy to alleviate your losses or to take advantage of opportunities.

How to evaluate market correlation

In order to assess the correlation between different cryptocurrencies, you will need information about their historical prices changes. Here’s a step -by -step guide:

- Select the relevant cryptocurrency : Select at least three to five cryptocurrency with good experience, such as Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC).

- Use Market Information Sources : Take advantage of reputable platforms such as CoinmarketCap, Cryptocompare or TradingView to collect historical price information for selected cryptocurrency.

- Calculate the correlation coefficients : You can use built -in functions on the platform of your choice or in third party libraries to calculate the correlation coefficient between two funds. Some popular options are:

* Pearson’s correlation coefficient (ρ): 0 ≤ ρ ≤ 1

* Spearman’s investment correlation coefficient: −1 ≤ ρ <1

- Interpret Results : Understand the meaning of correlation coefficients:

* Strong positive correlations show that when one cryptocurrency price rises, the other tends to follow.

* Weak or negative correlations indicate a lower relationship between property.

Real -world examples of cryptocurrency correlations

Let’s examine some examples of the real world to illustrate how market correlation works in practice:

- Bitcoin (BTC) and Ethereum (ETH) : Historically Bitcoin and Ethereum have shown a strong positive correlation, as both cryptocurrencies have grown together over time.

- Litecoin (LTC) and Bitcoin (BTC) : Litecoin strives to closely monitor Bitcoin’s price changes, but their correlation is slightly lower due to the differences in market value and trade.

- Bitcoin Cash (BCH) and Ethereum (ETH) : This couple has shown a strong negative correlation because the price of Bitcoin Cash has a tendency to fall as Ethereum’s price rises.

conclusion

Market correlation between cryptocurrencies is essential for conscious investment decisions. Understanding how different assets interact with each other, you can develop a more nuanced approach to managing portfolio and mitigating risks. Be sure to check the correlations of the couples regularly selected and adjust your strategy as market conditions change.