Suspension Orders Understanding: A Comprehensive Head of Cryptocurrency Traders

In the rapidly developing cryptocurrency trading world, the essential concept is very important to successfully and profitable transactions. One such concepts are the “STOP” order, which plays a vital role in the risks and restriction of potential losses. In this article, we will delve into the basics of stop orders, their importance in trade cryptocurrency trading and how to use them effectively.

What is the suspension order?

The stop order is an instruction of a merchant to sell or buy a certain cryptocurrency at a predefined price level, regardless of market conditions. In essence, it is a “stop loss” mechanism that determines the high trade prices, preventing the merchant from suffering significant losses if the market opposes them.

Why Use Stop Orders?

Stop orders are useful in several ways:

1

2.

3.

how do stop orders work?

Here is a step -by -step guide how stop orders work:

1

2.

3.

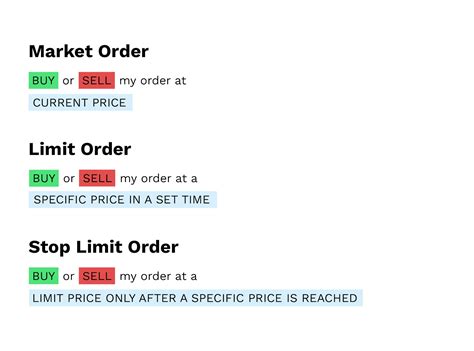

Stop Order Types

There are three main types of stop orders:

- Market order with stop (Moss) : Market Order with a stop set for the current market.

2.

3.

Using Suspension Orders in Cryptocurrency Trading

Successfully use stop orders for Cryptocurrency Trading:

1

2.

- Consider market conditions

: Take into account market conditions such as liquidity, volatility and market mood before commencement with stop order.

Best Stop Order Use Practice

To maximize the effectiveness of the stop orders:

- Use a FEW Stops : Connect A Few Stops To Create a Stop-Loss Strategy.

2.

- Observe and Adjust : Constantly Monitor Your Transactions and Adjust Stop Orders IF NECESSARY.

Conclusion

Stop orders are an essential cryptocurrency trading tool that gives traders flexibility to manage risk and restrict potential losses. Realizing how stop orders work and efficiently use them, traders can achieve greater success and market stability. Remember to keep a few stops, set warnings and constantly monitor your transactions to increase their effectiveness.